To create a real forex account for free, click here

What Is Forex?

Forex (FOReign EXchange) is the global currency market. It is a network of national and commercial banks, brokerage companies, and other economic agents engaged in purchasing and selling currency.

The foreign exchange market is the most liquid in the world. Its daily trade turnover reaches 7 trillion USD. Such volumes have become possible due to the market’s global nature and online transactions.

Unlike stock markets, Forex does not have a single center within which currency trading occurs. Partly because of this, it operates around the clock (except on weekends) and without clearing breaks, which is typical for exchanges.

To create a real forex account for free, click here

Forex transactions are divided into:

- hedging;

- trading;

- speculative;

- regulating (are carried out by central banks to regulate exchange rates).

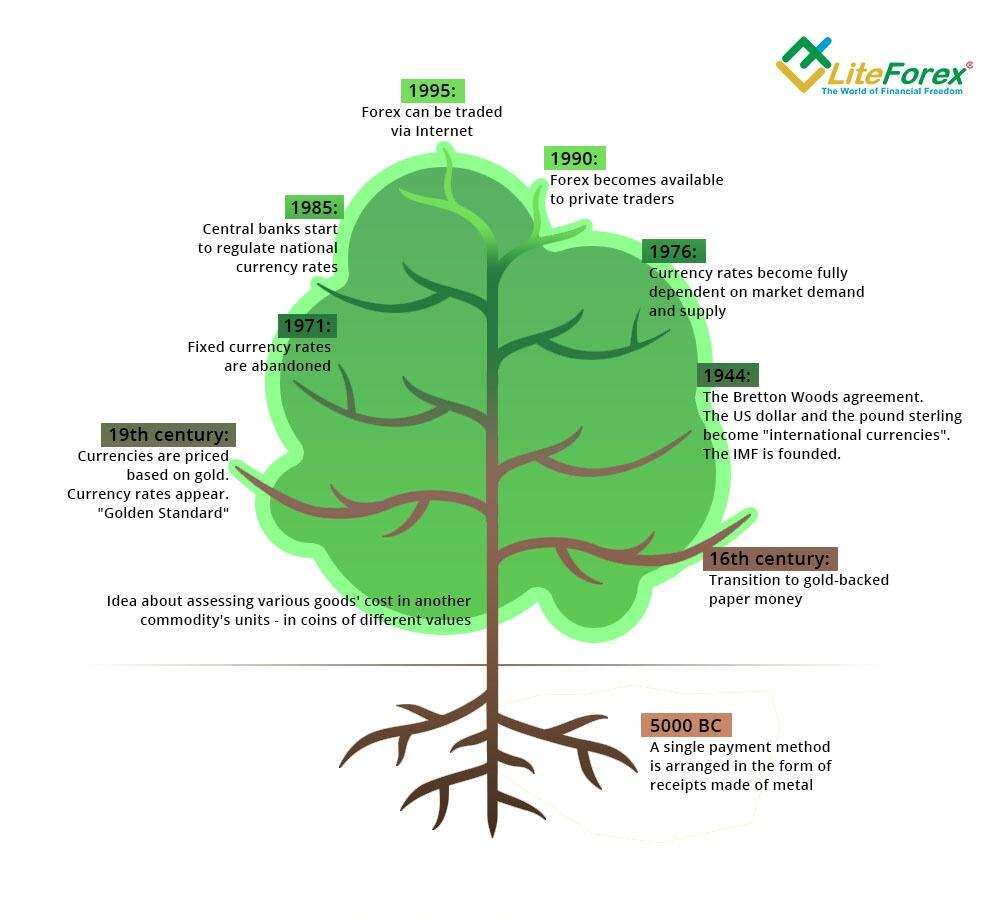

Know Your Forex History!

With the development of international trade at the end of the 16th century, people were faced with the fact that the coins of different countries had different weights and denominations. It was decided to switch to “identical” paper money, which can be exchanged for gold in a bank. Closer to the middle of the 19th century, the concept of “exchange rate in relation to gold” appeared. Thus the gold standard was born.

In 1944, the famous Bretton Woods agreement was signed to establish the International Monetary Fund. As a result, the US dollar and the British pound became international currencies.

In 1976, the gold standard was abolished, and exchange rates began to obey the market laws of supply and demand.

Since 1990, the Forex market has become available not only for large financial institutions but also for private investors and traders. After five years, it became possible to trade in the foreign exchange market via the Internet. Thus, 1995 marked the beginning of the modern Forex era.

To create a real forex account for free, click here

Forex Market Structure

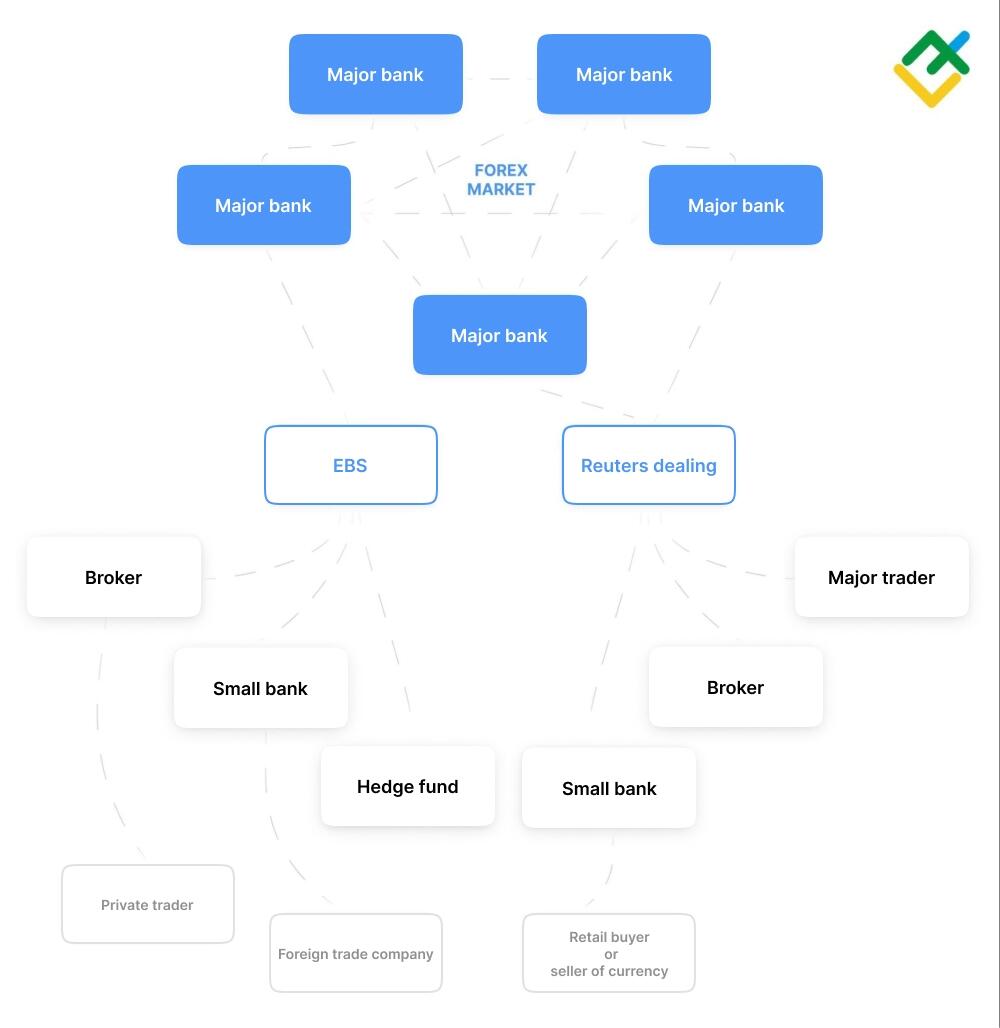

The main Forex turnover is provided by central banks and major commercial banks.

The main features of the FX market are its decentralization and round-the-clock trading. Forex is an over-the-counter market with no single center for trading. Round-the-clock weekday currency trading has become possible thanks to four trading sessions, each moving to the next one within 24 hours a day.

Market Size And Liquidity

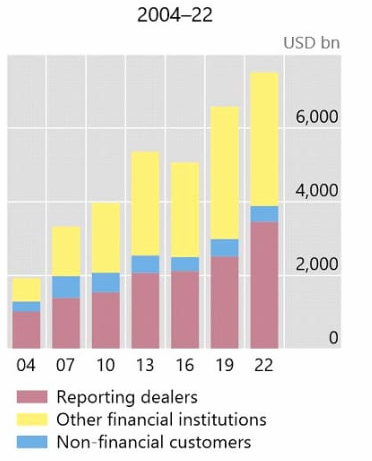

The Bank for International Settlements is studying the volume of the world currency market. Bank officials release a Forex liquidity and trading volume report every three years.

Since 1989, daily turnover has grown by an average of 25-30% in almost every reporting period. The dynamics have remained over the past ten years.

- 2010 – $4 trillion in a day;

- 2013 – $5.3 trillion in a day;

- 2016 – $5.1 trillion in a day;

- 2019 – $6.6 trillion in a day;

- 2022 – $7.5 trillion in a day.

Source: BIS Triennial Central Bank Survey.

Types of Forex Market

Three key types of foreign exchange markets are spot, forward, and futures. The difference between the markets lies in the delivery time. It can be fulfilled instantly or on a specific date.

Spot Foreign Exchange

In the spot market, trade is settled at the time of its conclusion. For example, if you bought a euro at 15:00 today, this currency will immediately appear in your account. Sometimes, this process can be delayed up to one or two days.

There are three types of contracts in the Forex spot market:

TOD. (today). The cheapest one. Payment is made during the day.

TOM. (tomorrow). Payment is made on the day following the transaction.

SPT. (spot or Т+2). Payment is made two working days after the conclusion of the trade.

With deferred settlement, the key rate is added to the size of the trade. In the case of TOM and SPT, for one and two days, respectively.

To create a real forex account for free, click here

Forward Foreign Exchange

A forward contract involves entering a buy or a sell trade of a currency pair in the future at a predetermined price. For example, you entered into a EUR forward contract at 15:00 today. This means that at some point in the future, you must buy, and the seller must sell the currency at a specified rate. Therefore, you will make a profit in the event of an increase in quotes in the future, as you will receive the agreed amount of euros “cheaper”.

The term of quotations of world currencies in the Forex forward market can reach up to one year. The longer the contract term, the lower the liquidity will be.

Futures Forex Market

The settlement of a futures contract, like a forward contract, is performed in the future. The main difference is that the execution date for a futures contract is strictly defined. Also, a futures contract can be resold to a third party, unlike a forward contract.

The parties choose the futures market if the buyer wants to insure against a decrease in the price of an asset and the seller against its increase.

There are two types of currency futures:

- contracts with settlement currency in US dollars (for example, GBP/USD);

- transactions based on cross rates of other currencies (for example, USD/TRY).

What Moves the Forex Market

On Forex, various surges are possible, inexplicable at first glance. They are often associated with global events that affect the global economy.

The scale of central banks’ activities, macroeconomic news in the world’s most developed countries, natural disasters, and other factors can affect currency quotes.

Central Bank

The main function of central banks is to ensure the stability of the national currency.

Changes in interest rates and foreign exchange interventions have the most significant impact on Forex quotes.

Central banks raise interest rates to fight inflation and lower them to stimulate economic growth.

The Central Bank directly affects the national currency’s exchange rate through interventions by buying and selling currency on Forex to increase or decrease the exchange rate to target values.

Sometimes even rumors about the intervention of the Central Bank can affect the exchange rate.

News Reports

As traders, we are interested in events that have a meaningful effect on quotes in a short amount of time.

The most significant price movements accompany news with so-called high priority. These are:

- Employment/unemployment levels;

- GDP (gross domestic product) of developed countries;

- Bank interest rate decisions;

- Monetary policy committee meeting.

You can analyze the list, date, and time of news reports in the LiteFinance economic calendar. You can set the display of high-priority news only. As a rule, the release of other news is not noticed by the market.

Is Forex Legit?

Is Forex trading legal? Many are interested in the answer to this question. Remember, the foreign exchange market, as well as the activities of Forex brokers, are regulated by law.

It’s not necessary for brokers to have a license to enter the interbank market. However, licensed brokers are more reliable because they are regularly audited, keep transparent accounting and have a compensation fund.

Three main bodies issue licenses confirming the reliability of a Forex broker:

- US Commodity Futures Trading Commission (CFTC) and US National Futures Association (NFA).

- The UK Financial Conduct Authority (FSA) and the Australian Securities and Investments Commission (ASIC).

- Cyprus Securities and Exchange Commission (CySEC) and Malta Financial Services Authority (MFSA).

What Is Traded In Forex?

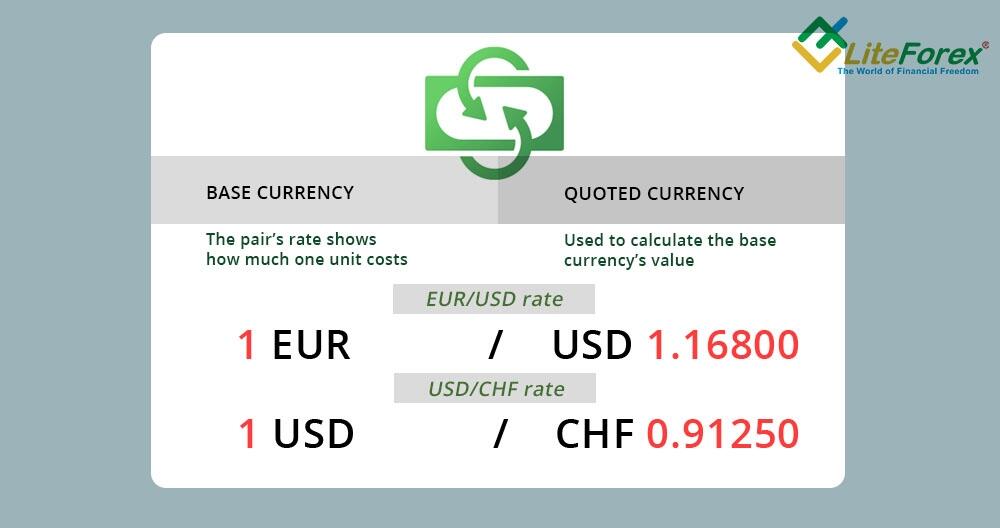

Forex is a trading platform for exchanging one currency for another. Based on the popularity of exchange operations (for example, the exchange of EUR for USD), currency pairs have been formed, which are the main foreign exchange market instruments.

Buying And Selling Currency Pairs

The main instrument of the fx market is currency pairs that express the value of one currency relative to another one. For example, in EUR/USD, the value of 1 euro will be expressed in US dollars.

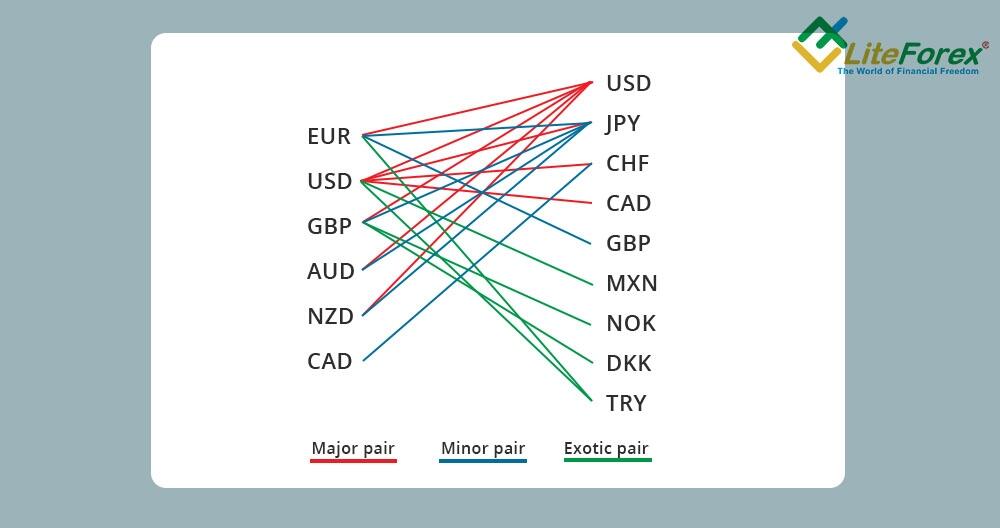

Popular pairs that account for the maximum trading volume are called major currency pairs or majors. The rest are called cross-rates.

The Most Traded Currency Pairs on Forex Markets

Major currency pairs include EUR/USD, USD/JPY, GBP/USD, USD/CAD, NZD/USD, USD/CHF, and AUD/USD. They are the most liquid, which is why their price movements are smooth.

Cross rates are more volatile currency pairs. On average, they move more pips per day, but their profit potential is significantly reduced by low liquidity. USD/PLN, USD/SGD, USD/CZK, USD/NOK, and other pairs are cross rates.

Who Trades Forex?

Central and commercial banks, investment and pension funds, and large companies associated with foreign economic activity are Forex market participants, which form the main trade turnover. These financial institutions use Forex mainly for currency exchange transactions and less for speculation.

Who trades in Forex:

- Banks and international financial institutions;

- Large commercial companies;

- Governments and central banks;

- Speculators and private traders.

The chain of participants for private traders is limited to their Forex broker and liquidity provider.

A Forex broker or Forex dealer is a financial institution providing traders access to trading in the foreign exchange market. The broker also provides the trader with the necessary tools, including a trading terminal with online quotes, a trading account, access to analytics, and the ability to use leverage.

Liquidity providers, as a rule, are international banks, which are representatives of the foreign exchange market. They provide quotes of currency pairs to a Forex broker.

How to Trade Forex for Beginners?

To start Forex trading, you need to register with a broker, download a client terminal and open a demo or real trading account.

Potential profit and possible risks of traders depend on the volume of transactions, which are indicated in lots.

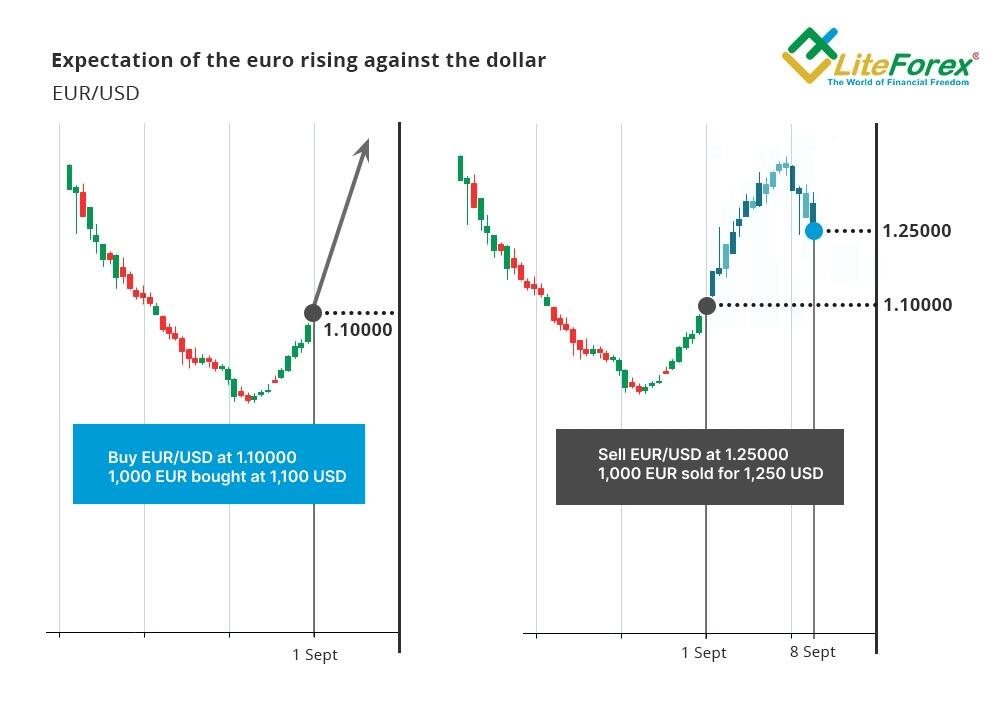

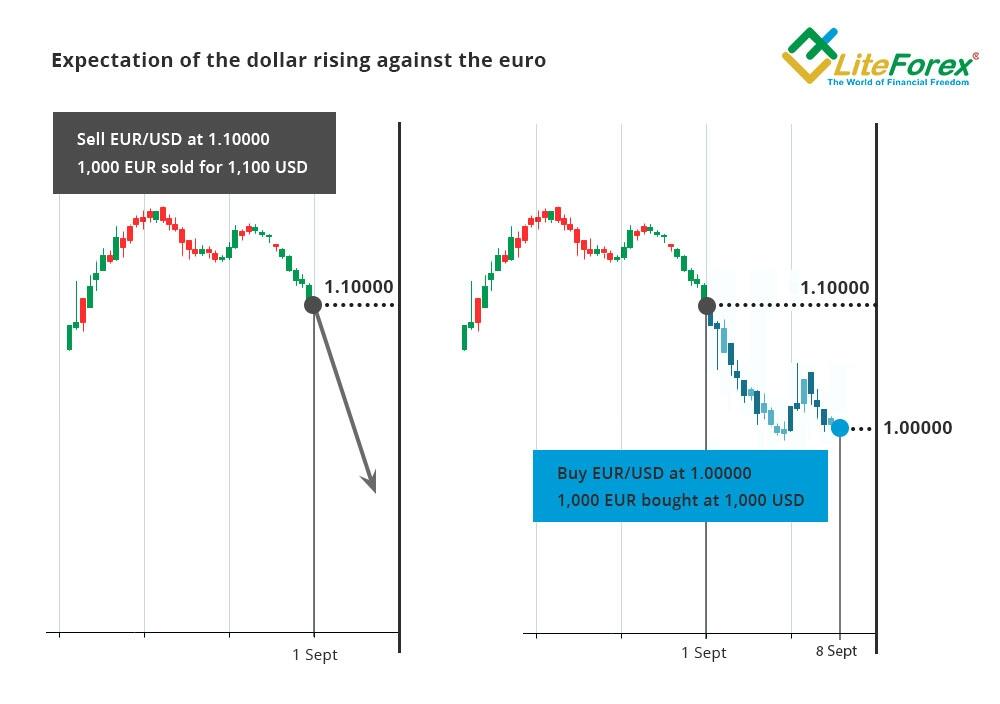

How to trade in Forex? Traders can earn both on the growth and the decline of quotes. Accordingly, there are two types of transactions:

- buying or opening a long trade;

- selling or opening a short trade.

If traders predict an asset’s future growth, it is necessary to open a long trade to make a profit. If a decline is expected, open a short trade.

Use a stop loss on every trade. This protective order will close the trade if the price goes contrary to the trader’s forecast.

Basic Concepts

To be successful in foreign exchange trading, you need to gradually update your trading skills. The first step is to learn basic terms such as pip, lot, spread, leverage, and margin.

What is a Pip in Forex?

Novice traders often ask what a pip is in Forex trading and how to determine its size. A pip in Forex is the minimum amount by which the value of a trading instrument can change. For example, for a GBP/USD pair with a five-digit quote, one pip = $0.00001.

What is a Lot in Forex?

Lot in Forex is a standard unit for measuring the volume of a currency position opened by a trader.

If a trader buys EUR/USD with a volume of 1 lot, then he/she buys 100,000 euros. Most Forex traders use leverage and trade through brokers, so they need less money.

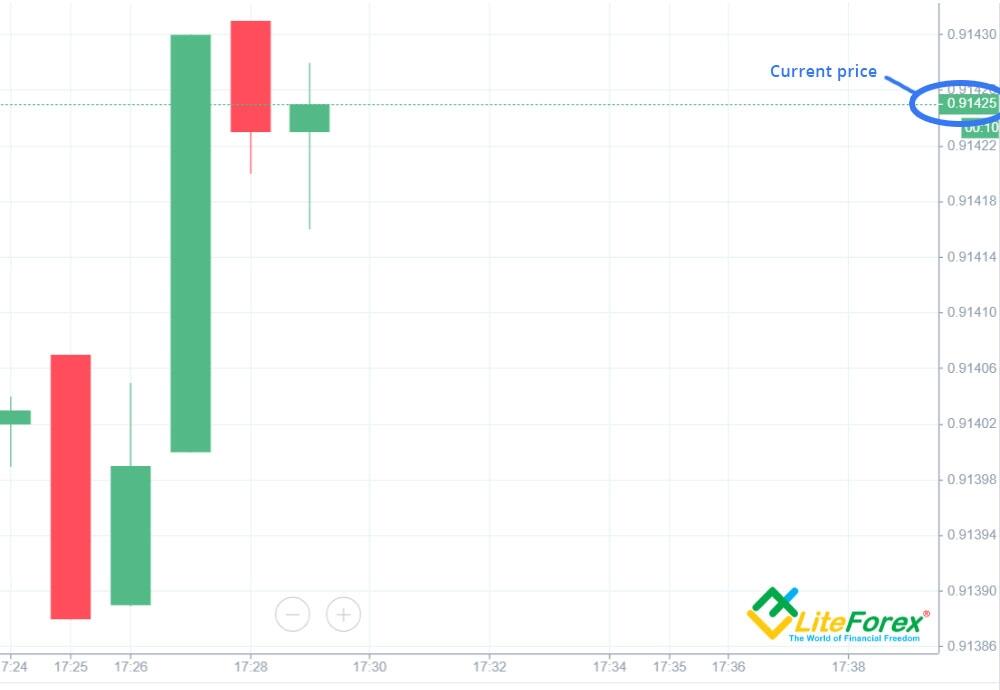

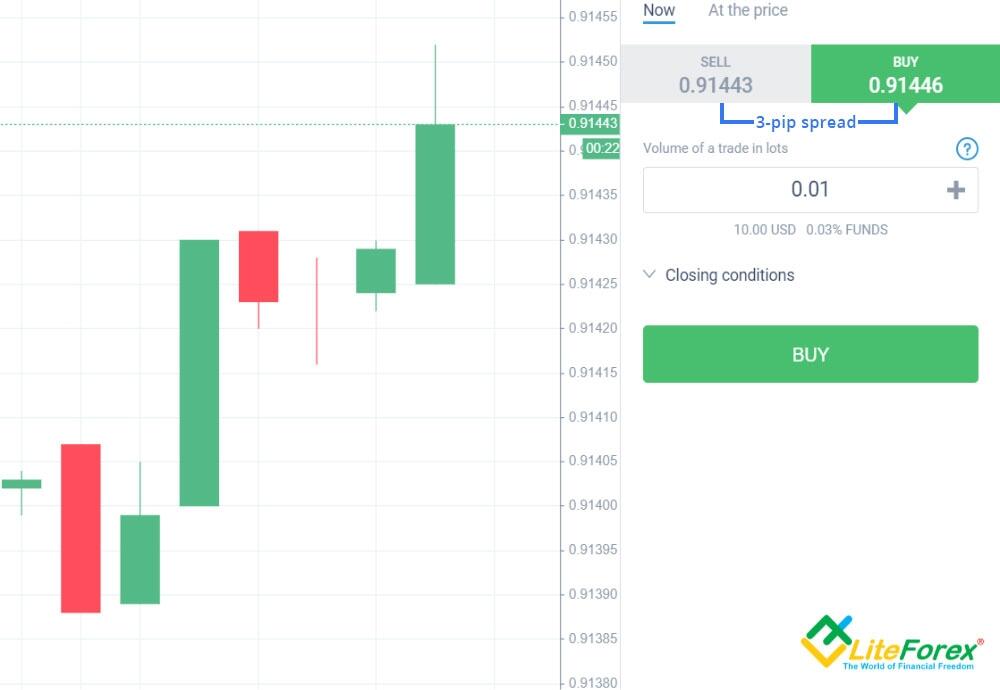

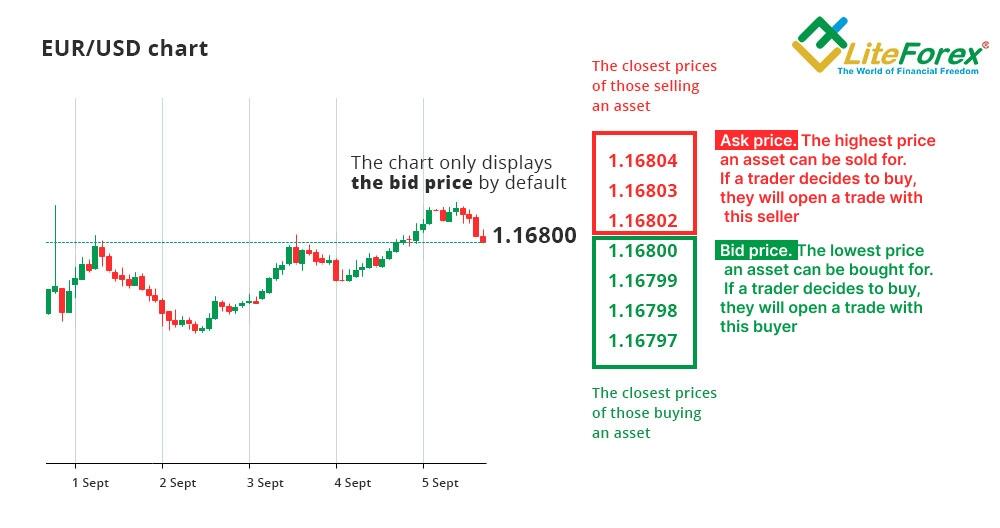

What is a Spread in Forex?

Forex spread is the difference between the lowest selling price (“ask”) and the highest buying price (“bid”).

If bid = 0.91437 and ask = 0.91440, the spread is three pips.

Since we always buy at the ask price (higher) and sell at the bid price (lower), the spread must be added to the expected price movement.

What is Leverage in Forex?

Leverage in Forex is the ratio of a trader’s funds and the position volume he/she is opening. Leverage can increase investments by 10, 100, and even 1000 times. This option allows traders to make transactions in the Forex market with a smaller deposit than is required to buy one standard lot, that is, 100,000 currency units.

What is Margin in Forex?

Margin is the amount a trader needs to have to maintain open positions. These funds are locked in the trader’s account until the position is closed. The higher the leverage, the less money you need to open a trade. Hence, the smaller the margin will be.

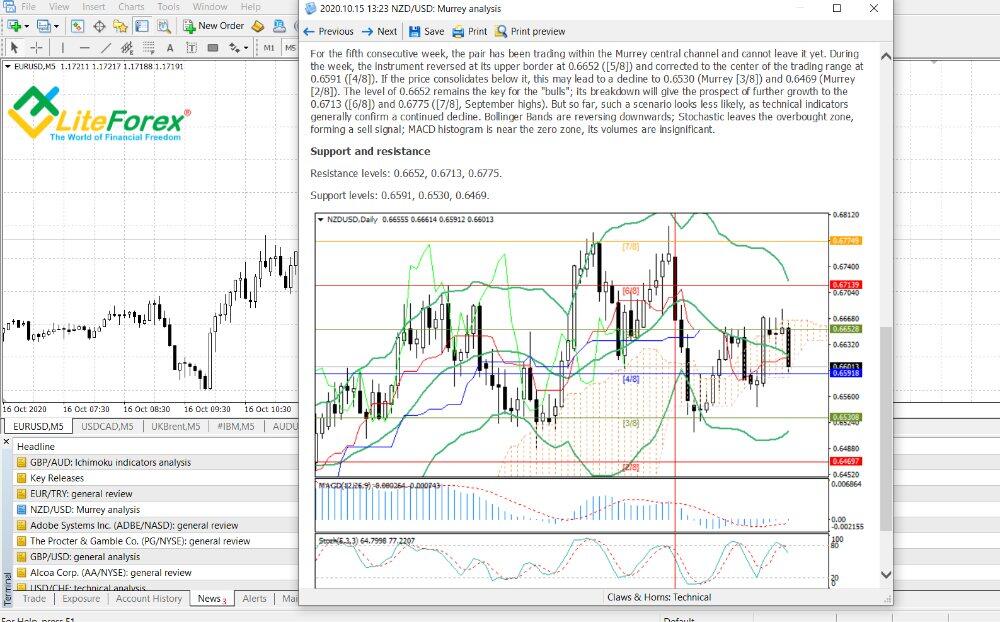

Three Types of Analysis

In Forex, traders usually use three types of analysis:

- Technical. The object of analysis is the price chart.

- Fundamental analysis studies macroeconomic indicators and news.

- Analysis of market sentiment on open buy and sell trades.

Technical Analysis

In technical analysis, price movements are studied without considering the reasons they are caused.

The technical analysis tools are below:

- Chart patterns (head and shoulders, triangle, flag, etc.) form the price movement.

- Indicators are instruments that are calculated based on price values. They help the analyst to filter out false signals and make more accurate predictions. Moving averages and stochastic oscillators are among the most popular indicators.

- Candlestick patterns are displayed in the chart as price candles. The forecast is based on the type of candles and their combinations, for example, pin bar or absorption.

Fundamental Analysis

Fundamental Forex analysis studies macroeconomic news that can change currencies’ supply and demand. Usually, such forecasts are medium- and long-term.

Fundamental factors include:

- News and data relating to the economic situation in the country, including unemployment and retail sales, consumer price indices, and US Federal Reserve decisions. It is most convenient to track such information using the economic calendar.

- Geopolitical events such as elections, trade cooperation between countries, and participation in joint national projects.

- Global force majeure, including natural disasters, military actions, and strikes.

Sentiment Analysis

Market sentiment is the ratio of open buy and sell trades for a particular instrument.

- If the volume of open purchases > the volume of open sales, then most market participants predict a price increase.

- If the volume of open sales > the volume of open purchases, then most market participants expect a price decrease.

Previously opened positions do not affect the current and future price movement. In addition, the main Forex participants are banks that open trades not for speculative purposes but because of the need for a particular currency.

Types of Charts

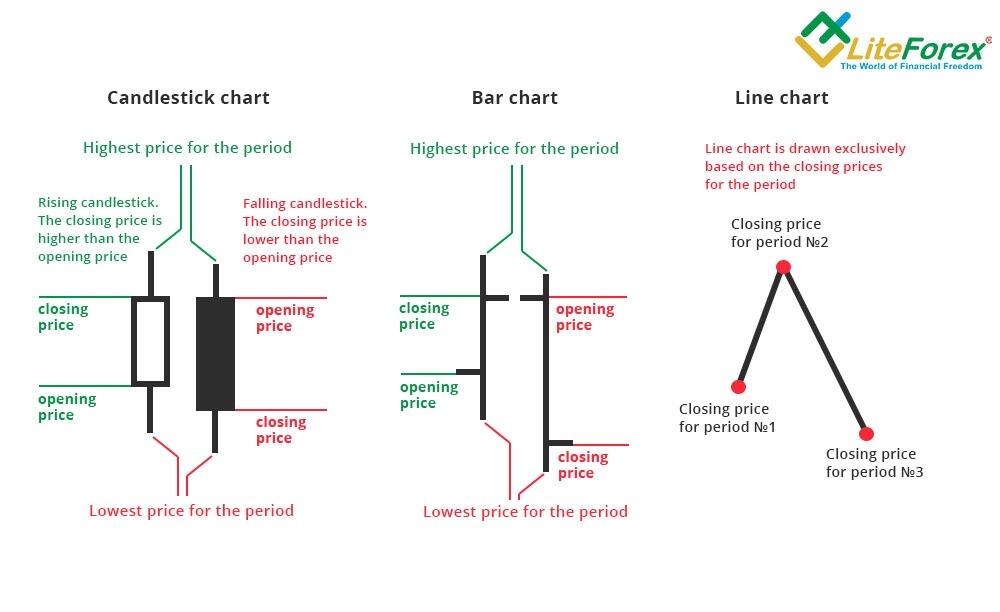

Price information for Forex instruments is usually displayed in the chart as candlesticks, bars, or lines.

Candlesticks best show the situation in the chart. They are built on four main points:

- price at the beginning of the period;

- minimum price for the period;

- maximum price for the period;

- price at the end of the period.

Bars are built using the same four points. This type of chart is used by traders who only need to know only the maximum and minimum prices for the period.

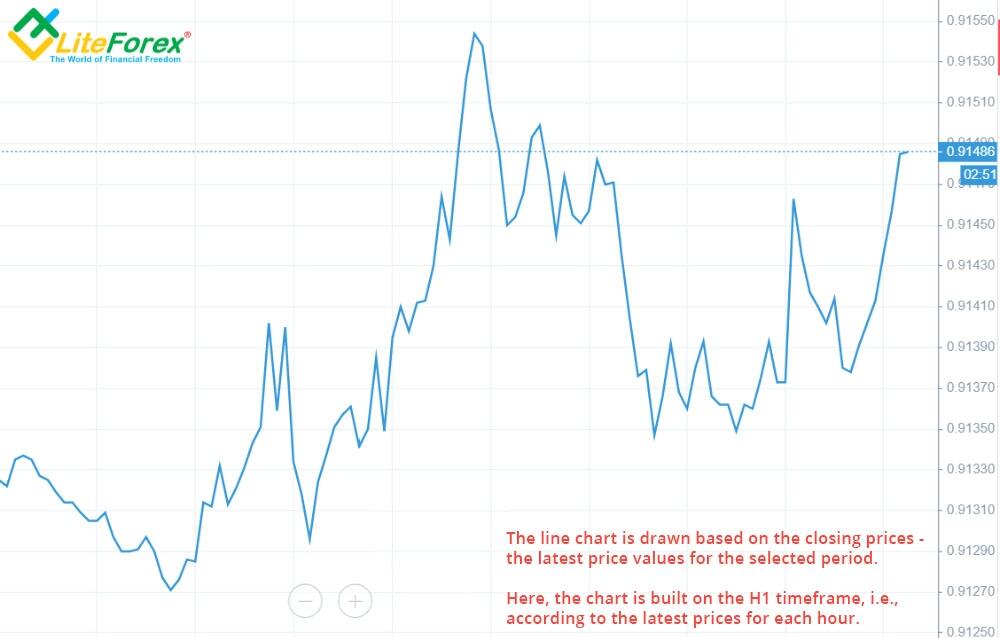

The line chart is based on the last price of each period or the closing price. It is ideal for analyzing the overall picture but not very good in terms of detail.

Experienced Forex traders carefully study chart patterns. Various models can predict price reversals and optimal market entry points.

Candlestick Charts

Candlestick charts reflect price dynamics in the form of Japanese candles. The type of candle depends on the change in the highest and lowest prices for a certain period:

- if the closing price is lower than the opening price, then the candle becomes descending (usually black or red);

- if the closing price is higher than the opening price, then the candle becomes ascending (white or green).

When analyzing candlestick patterns, pay attention to the color of the candlestick to identify strong signals for opening trades (for example, bullish engulfing).

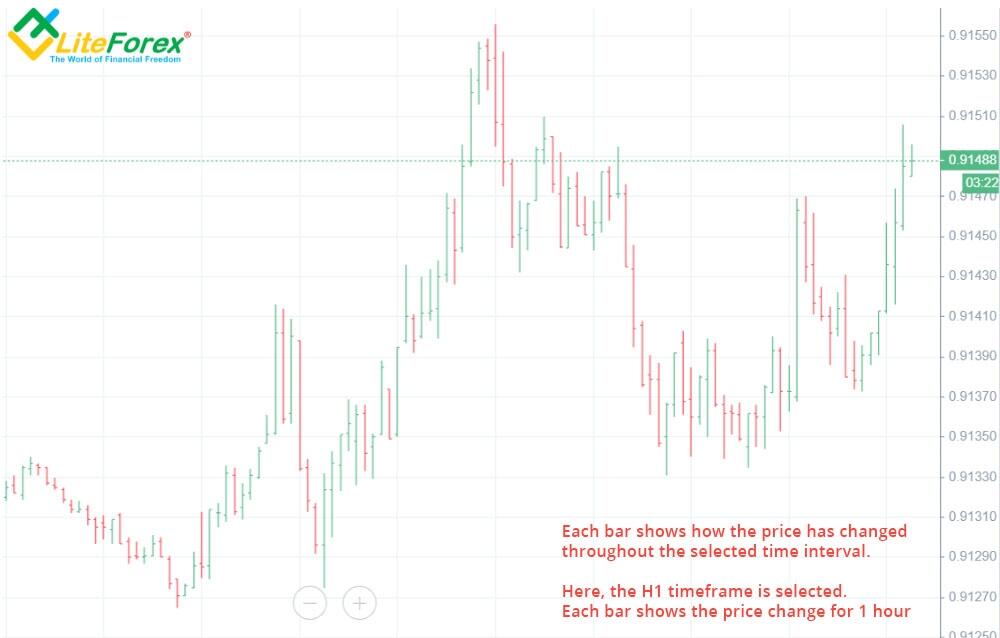

Bar Charts

Bar charts well reflect the highest and lowest prices of the instrument for the selected period. The opening and closing prices of the period are shown as small horizontal lines to the left and right of the bar, respectively.

The bar chart is suitable for chart figures and price levels.

Line Charts

Line charts are based on the prices of the last transaction for the selected time period. For example, on a line chart with the H1 timeframe, each of its points reflects the last market price for the past hour. This type of chart does not provide information on how the price has changed during each hour.

How to Make Money Trading Forex

Novice traders looking for information on how to make money on Forex usually find false information based on making the most accurate forecasts. As a result, traders tend not to gain the experience necessary for success in any business but are simply looking for ways to predict prices.

Hedge funds consistently make money from trading. Information about their profitability is publicly available. According to their founders, their success is based on:

- profitable currency trading strategy;

- the ability to comply with the rules of this strategy;

- risk management based on the amount of capital.

Types of Forex Orders

There are two types of orders in Forex:

- market;

- pending.

Market buy and sell orders are concluded at the current ask and bid prices, respectively. These include market buy and market sell.

Pending orders are placed at a certain price value. They will be executed only if the price reaches these values. Pending orders are also divided into two types:

- Limit orders are directed against the price movement (buy limit, sell limit, take profit).

- Stop orders that follow the price movement (buy stop, sell stop, stop-loss).

When to Buy or Sell a Currency Pair?

For the first few years, Forex traders try to figure out when to buy or sell.

This is due to the false assumption that market movements can be predicted. Over time, they realize that it is impossible to determine the direction of future currency prices in advance. Thus, they begin to look for ways that will allow them to make a profit after a series of transactions.

Therefore, enter purchases or sales following the rules of your trading strategy.

Demo Trade Your Way to Success

When trading on a demo account, traders get access to market quotes without risking real money.

The importance of a demo account for FX trading is hugely underestimated. With the help of a demo account, users can test not only a trading strategy but also their ability to follow it in conditions that are as close to real as possible.

Switch from a demo account to a real one if:

- the overall result of a series of 100 trades is near 0 or positive;

- you have developed a trading strategy with clear rules for opening and closing trades.

Trading Psychology

Novice traders are not aware of the influence of various emotions on their decisions. This is the main problem related to the psychology of Forex trading.

The psychology of traders should be characterized by the phrase “I’m not the smartest”. We must accept that the ability to predict is very limited. Do not overestimate the requirements for yourself about the percentage of profitable trades and the rate of return.

This attitude towards trading is developed after many years of successes and mistakes.

Can You Get Rich By Trading Forex?

Getting rich means getting a lot of money. Therefore, the focus immediately shifts from wanting to become a good trader to getting material possessions.

In Forex, as in any other industry, you can get rich only by becoming a professional.

Forex allows traders to use large leverage. Therefore, theoretically, you can earn a lot one day while risking your entire deposit. However, remember that this type of Forex trading is profitable only if you do not use it constantly.

Basic Forex Trading Strategies

A Forex trading strategy, as a rule, involves making decisions based on an analysis of the price movement of an asset.

The best Forex trading strategies are based on identifying a characteristic price pattern that has regularly repeated. Such strategies describe the conditions for entering and exiting a Forex trade (with profit or loss) within this price pattern.

Forex trading approaches can be divided according to the method of chart analysis and the transaction duration.

According to the analysis method:

- price action strategies;

- channel trading strategies;

- trend trading strategies.

According to the transaction duration:

- position;

- intraday;

- scalping;

- swing trading.

There are also trading strategies that do not fall into any category, such as carry trade, margin, and automatic.

1. Strategy Price Action

The classic price action strategy is based on one or more price candles of a certain shape. Each price action pattern reflects the behavior of buyers and sellers at certain prices within the selected timeframe.

Popular price action pin bar and engulfing patterns indicate a potential price reversal due to increased trading volume in the opposite direction of the current trend.

2. Channel Trading Strategies

Channel trading strategies are based on wave-like price movement. The lower border of the price channel is built on price troughs, and the upper one is on price peaks.

The channel can be either upward or downward.

Forex trades can be opened when the price has rebounded from the channel border, as well as when it has broken out the border, expecting a further movement in the same direction.

3. Trend Trading Strategies

Forex trend strategies use indicators that determine the state of the market.

If a set of indicators suggests the probable beginning of an uptrend, then a buy trade is opened. If indicators show the beginning of a downtrend, a sell trade is opened.

If the indicators show a flat in Forex, then there are no signals to enter the market.

Use trending strategies when trading instruments with medium volatility.

4. Positional Trading Strategy

A positional trading strategy involves opening long-term Forex trades. Therefore, large timeframes from D1 and above are used. Positional traders tend to use both technical and fundamental analysis. The approximate number of trades is up to 10 per year. Trades are opened based on a long-term trend. Trading between the borders of the flat is ignored.

5. Intraday Strategy

As part of intraday trading, traders make up to five trades per day. Trades usually open at a certain time, during a certain trading session, when the selected instrument is most liquid and volatile.

The average time spent in a trade is from 1 to 60 minutes.

Due to small take profits, the result is significantly affected by the spread.

6. Scalping Strategy

To use this strategy, traders need to have the proper equipment. The duration of transactions ranges from several seconds to several minutes. Scalpers expect small price movements, so the slightest delay (due to a slow Internet connection or an insufficiently powerful computer) can reduce profits.

The Scalping Strategy can be used during any trading session, during both high and low volatility. The main criterion is a narrow spread of the instrument.

7. Swing Trading

The main feature of swing trading is the carrying over of open positions to the next day. The average trade time ranges from one day to several weeks. Swing traders can analyze even lower timeframes for a more accurate entry point and profit maximization.

As part of this strategy, you can trade almost any instrument since the spread represents only a small percentage of the take profit value.

8. Carry Trade

Carry trading is a trading strategy that does not depend on the price direction. It consists in making a profit from swap calculation while carrying out an open position the next day. Based on the difference in interest rates of banks in different countries, the swap for some currency pairs can be positive.

9. Margin Trading

Margin trading strategy is not a trading approach with classical rules for opening and closing trades. This is a general term for the use of leverage in Forex trading.

Most strategies in Forex imply marginality; since the price changes of currency pairs are too small, the profit will be small if you trade only with your funds.

10. Automated Trading

Automatic Forex strategies or algo-trading consist of using trading robots, the special programs that trade independently, without the participation of traders. This type of trading does not involve AI since the built-in algorithm makes decisions to open and close trade.

Automatic strategies are often based on flat trading and are widely used during low volatility.

When Can You Trade Foreign Exchange Market?

The time for Forex trading should be chosen depending on which currency pair you plan to trade. The optimal time for trading major currencies is during the working hours of financial institutions in Europe, America, and Asia. The surge in activity during trading Asian currencies coincides with the period of operation of the Tokyo and Singapore Stock Exchanges.

Forex Trading Sessions

Forex trading hours are associated with four trading sessions:

- Pacific (22:00 – 06:00 UTC/GMT 0);

- Asian (24:00 – 08:00 UTC/GMT 0);

- European (08:00 – 16:00 UTC/GMT 0);

- American (13:00 – 21:00 UTC/GMT 0).

Tokyo Session

The three biggest stock exchanges provide for the operation of the Asian session: HKE HONG KONG, SSE SHANGHAI, and TSE TOKYO.

JPY, SGD, and CNY are actively traded during this session, while the major currency pairs have low volatility during these hours.

London Session

The four biggest stock exchanges provide for the operation of the European trading session: LSE LONDON, SIX ZURICH, FWB FRANKFURT, and JSE JOHANNESBURG.

During this trading session, major currency pairs in Forex often show high volatility compared to the Asian session. The EUR, GBP, and CHF trading activity is increasing.

New York Session

The American or New York Forex trading session starts immediately after the European one. As a result, the volatility of the major currency pairs remains high.

The three biggest stock exchanges provide for the operation of the American trading session: CHX CHICAGO, NYSE NEW YORK, and TSX TORONTO.

Pairs, including USD и CAD, are most actively traded during the American session.

Sydney Session

The two biggest stock exchanges provide for the operation of the Pacific session: NZX WELLINGTON and ASX SYDNEY. Pairs, including AUD и NZD, are most actively traded.

Best Times of Day to Trade Forex

The best time for day trading on Forex with major currency pairs in terms of liquidity and profit potential is during the European and American sessions.

However, periods of increased volatility for Forex trading are not suitable for everyone. If traders are good at trading during periods of flat and/or low volatility, then it is better to select the Asian or Pacific sessions and choose currencies that are actively traded during these periods.

The liquidity of a particular currency depends on the current session. For example, liquidity of European currencies (EUR, GBP, CHF) increases during the European session, since European financial centers are open at this time, and dollars’ liquidity (USD, CAD) rises during the American session. JPY and SGD are the most liquid during the Asian session, while NZD and AUD are during the Pacific session.

Best Days of the Week to Trade Forex

Differences in price movements by day of the week are minimal. Wednesday is characterized by a slight decrease in volatility compared to Monday and Tuesday. On Fridays, the price is often in a flat. Therefore, the best days for trend trading are Monday, Tuesday, and Thursday. Wednesday and Friday are more suitable for trading during a flat market and low volatility.

Why Trade Forex?

To open a Forex account, it is enough to register with a broker. Forex brokers provide an opportunity to trade with minimum volumes from 0.01 lots and use leverage up to 1:1000. Therefore, you can trade some instruments with a deposit of $50 or more. Forex trading is open 24/5, so traders may not follow the operating periods of a particular exchange.

Forex vs. Stocks

If we compare stock trading vs. Forex trading, the foreign exchange market wins in terms of liquidity, ease of opening an account, and trading duration. The stock market will be preferable in terms of the number of popular instruments, the size of the spread, and the transparency of trading.

Forex liquidity exceeds the liquidity of all world exchanges. To open a Forex account, you only need to register with a broker. To access stock trading, you need to provide a package of documents.

Forex trading goes around the clock. Stocks are limited by the time of the exchange.

Stocks of several thousand companies are traded on world stock exchanges, while the number of currencies in the world is significantly smaller.

Some liquid stocks may have a zero spread, which is unlikely in the Forex market.

The decentralization of the Forex market and the centralization of exchanges make trading transparent. All information about trading volumes is publicly available.

Forex vs. Futures

The main difference between the Forex and the stock market lies in the set of trading instruments. Currency pairs are traded on Forex, while stocks and various derivatives such as futures, options, ETFs, and others are traded on the stock market.

Unlike the stock market, Forex trading continues 24 hours a day as one trading session turns into another. At the same time, both markets are closed on Saturday and Sunday.

The stock market provides less leverage (up to 1/10), but the volatility of stocks, futures, and other instruments is higher than that of currency pairs. Therefore, large leverage is not required here.

Also, information on trading volumes is available on the centralized stock market, unlike Forex.

Advantages Of Forex Trading

Main advantages of Forex trading:

- trading is available at any time of the day;

- ease of opening a Forex trading account;

- high liquidity;

- leverage function;

- the opportunity to try out your strategies on a demo account;

- trading is possible even with a small deposit;

- the list of trading instruments includes currency pairs, index CFDs, stocks and commodities, cryptocurrencies;

- high-volatility and low-volatility periods alternate throughout the day, which allows traders to apply various trading methods and strategies;

- a wide range of instruments of Forex brokers includes forecasts for various assets, a calendar of economic news, trading signals, and the ability to analyze transactions of other traders.

In the Forex market, creating artificial demand or supply is impossible, as trading volumes are too large. Some brokers provide a service for copying the actions of other traders. You can also provide your transactions for copying.

With a smooth return chart, this makes it possible to increase the deposit at the expense of investors’ funds.

Forex Risks & Opportunities

It is necessary to conduct a comprehensive assessment of both opportunities and risks when trading on Forex:

| Opportunities | Risks |

| Leverage | Influence of gambling on decision making |

| Narrow spread and short-term trading opportunities | Slippage and requotes |

| Ability to increase the deposit several times | Risk of losing a deposit |

| Free access to educational and analytical materials | The accuracy of analytical forecasts is not 100% |

Let’s analyze the risk impact.

- The ability to trade using all funds multiplied by excitement. Beginning Forex traders cannot realize the degree of influence of instincts and emotions on the trading process as they have not yet faced it. The risk of making emotional decisions is in the first place, and it is difficult to control it. Leverage can become a disadvantage for traders if, in an effort to make money as quickly as possible, they do not follow the rules of risk management. On the other hand, leverage is useful to lower the minimum deposit amount.

- The risk of slippage and requotes means that orders may not be triggered at a predetermined price. This is due to the alternation of periods of low and high liquidity of the instrument. To avoid this risk, use the economic calendar and do not enter trades in anticipation of important news releases. During periods of high liquidity, Forex traders can even enter scalping trades as the spread size will be suitable on some types of accounts.

- The high risk of losing a deposit is associated with violating risk management rules or an early transition from a demo account to a real one. It is not recommended to trade on a real account until your demo result is near zero or slightly positive. Otherwise, your psyche may not be ready, increasing the possibility of making emotional decisions. On the other hand, with a competent approach, traders can gradually increase the deposit by several times.

- It is impossible to exactly determine future quotes using any type of analysis. The risks of failed predictions are related to the nature of Forex price movements. Analytical forecasts do not guarantee a match with actual data. However, they can provide an overview of the current macroeconomic situation related to the trading instrument.

Forex traders always operate under unclear circumstances, so you should reduce the risks you can control.