To create a real forex account for free, click here

In this article, I will discuss the nuances of currency market trading. Like 10 or 20 years ago, today Forex trading remains one of the fastest and most significant means of online earning. And if for some reason you are not yet a Forex trader, you should read this article and find out what currency market trading is.

What is Currency Trading?

The concept of currencies trading originated long ago, when the first currency exchanges appeared. Forex traders were legal entities that bought foreign currency as cheaply as possible and then sold it several times more expensive and enjoyed the difference.

Let’s consider a Forex trading example, a trader bought 100 British pounds for dollars at a price of 1 pound per 1 dollar. After that, some time passed, the value of the pound increased, and when it reached $2 per 1 pound, they sold them and got $200. Thus, the trader’s profit was $100.

Modern Forex trading remains basically unchanged, the only difference is that the first Forex traders made foreign exchange transactions with their own funds. Now we have access to a margin lending system that allows us to trade Forex with the funds borrowed from Forex brokers.

For example, let’s imagine the same transaction of 100 pounds bought for dollars, but this time using leverage. A trader buys 100 pounds for 100 dollars, but with a leverage of 1:100. Therefore, the volume of the trade increases by 100 times. This means that the actual value will not be 100, but 10,000 dollars. When you sell currencies, the value of one currency will no longer be 200, but 20,000, and the difference will not be 100, but rather 10,000 dollars.

How Does Currency Trading Work?

Initially, the exchange was a global venue for exchanging currency. Countries and state corporations made transactions to exchange national currencies to pay for exports and imports.

The modern currency exchange has much more to offer than just exchanging currencies. Now here you can trade Forex, stocks, metals, oil, and even cryptocurrencies.

Forex is the only global exchange that operates 24 hours a day. If a company in Europe wants to trade major currencies such as EUR USD, it doesn’t have to wait until morning comes in the US and the banks open. It performs its transaction on the currency exchange at a convenient time.

The uninterrupted 24-hour operation of the currency exchange is ensured by four trading sessions that follow each other: Asian, Pacific, European, and American. After the US exchange closes, the Tokyo exchange opens, and after the Tokyo exchange closes, the Sydney exchange opens, and so on.

This way, Forex traders from any part of the world at any time have access to transactions in currency pairs. This is what makes Forex markets more profitable than the stock exchange, which operates over certain periods.

How to get into currency trading

How to start trading Forex? The answer is quite simple and involves several steps. It all comes down to opening retail investor accounts and making trades. But in order to profit from trading, you must follow clear instructions.

- The first step is to decide on the exchange on which you will trade Forex. If you intend to trade currencies, then it’s currency exchange, or Forex markets.

- Now you need to choose an intermediary who will give you access to the world currency exchange. The intermediary is a Forex broker. If you want to know how to choose a Forex trading provider, you can read more about this in my colleague’s article.

- Next, you need to register retail investor accounts on the Forex broker’s website and open a demo account. It is ideal for training and learning. With it, you will understand how foreign exchange trading (Forex trading) works.

- Once you feel ready to trade Forex with real/virtual money, open a trading account. Here you can find out how to do it and what types of trading retail investor accounts are available.

- Next, you need to deposit real or virtual money to your trading account. This can be done in many ways from electronic wallets to bank transfer.

- After the money is in the trading account, select currency pairs you are interested in and start trading Forex and earning money.

- And yes, if you are still not completely confident in your abilities, you can get help or advice from professionals who have developed many excellent profitable trading strategies, the best of which you can find on the blog.

How to learn currency trading

In recent years, the openness of Forex markets has grown greatly and now a huge amount of information is available to anyone. The fastest and least expensive way to learn Forex trading is to find a tutor or coach. If you manage to find such a person in your city, you will walk this path with them shoulder to shoulder. By practicing trading with an experienced trader, you will quickly understand all the nuances of this occupation.

In the article “The Best Ways to Learn Forex Trading from Scratch”, I described in detail the best options to start learning.

I also advise you to read the article “Forex Mentor: Pros and Cons for a Novice Trader”, which will help you choose the right coach.

Currency trading books

When it comes to the literature that contributed to my formation as a trader, I should make a disclaimer: these are not modern books. In my opinion, contemporary books like “Trading for Dummies” or “5 Secret Trading Strategies” are nothing more than marketing, and they are written solely for the purpose of making money. As George Soros once said: “If you want to learn, learn from those who are at the source.”

I have made a list of my TOP 3 trading books.

1. Reminiscences of a Stock Operator, Edwin Lefèvre.

Most Forex traders, myself included, consider this book to be the best guide to how exchange trading works. It describes the biography of the legendary trader Jesse Livermore and essentially tells about the situations he found himself in. The most valuable concept in this book is psychology in trading. It describes many trades and the decision-making process that led to them. The process of market manipulation by banks and other financial institutions is also wonderfully revealed.

If you are interested in the history of trading, understanding the processes that take place on the market and the whole truth about the exchange, this book should be your first choice.

2. The Intelligent Investor, Benjamin Graham

The author of The Intelligent Investor was Warren Buffett’s teacher himself. His book is considered the masterpiece of classical trading. It talks about the impact of macroeconomic processes on financial assets. In fact, this is a guide to how economic indicators and fundamental analysis tools in general, such as inflation and monetary policy, affect the state of the market. In the book, the author describes portfolio investments in detail and explains the principles of portfolio management.

Graham’s books are quite difficult to understand and are suitable for those who already know a thing or two about trading. But if you find it in you to delve into the Intelligent Investor, it will help you create your own strategies, which, if properly implemented, will bring you a stable income.

3. The Dow Theory, Rhea Robert

The best Dow Theory collection I read is the articles published by William Peter Hamilton, Robert Rhea and E. George Schaefer in The Wall Street Journal after Charles H. Dow death.

In this collection you can learn about the three main principles of technical analysis and, most importantly, about the concepts of trends and corrections in the market as they were formulated by the author, rather than the form in which they are presented in modern literature.

In general, if you want to understand technical analysis in its original form, take the time to find books on Charles Dow’s classic theory online.

Books are one way to learn how to work on the exchange. But you should understand that only reading them will not bring you income. To earn money, you need to apply the acquired knowledge in practice by trading. Who seeks millions very rarely finds them. But whoever does not seek, never finds. So do not stand still and look for your ways to earn money.”

What drives currency movements?

Exchange rates and currency prices, like the prices of other commodities, are in constant movement under the influence of various factors. Price changes create the opportunity to earn on the difference in exchange rates.

There are many reasons why there are exchange rates and price movements. Let’s look at the most important ones.

Interest rates

The interest rates of central banks around the world are a key factor influencing the exchange rate. The central bank of each country sets the interest rates at which commercial banks borrow money and distribute it to other consumers. The interest rate is the main parameter of the state’s monetary policy.

An increase in the interest rate leads to a decrease in inflation, which means it increases interest in risky assets, and the national currency of the country usually grows. A fall in its exchange rate usually also reduces the cost of loans for commercial banks and businesses, which can cause inflation to rise and cause a decrease in demand for the national currency.

Inflation

Inflation is the process of the prices of consumer goods changing within a country. An increase in inflation causes an increase in goods prices, which in turn leads to a depreciation of the national currency. If inflation falls, domestic goods become cheaper, making the national currency stronger.

However, this formula is not entirely complete, since the effect of inflation on the quotes of the national currency all over the world is sometimes greatly distorted. This is often observed when real inflation is well above the target range set by the central bank. In this case, the national currency can become an indicator of future inflation – an increase in the exchange rate can lead to its subsequent decrease.

Economic performance

Other macroeconomic indicators also have a serious impact on the exchange rate of the national currency. The key ones are gross domestic product or GDP, as well as indicators of the state of the labor market, such as the unemployment rate or jobless claims.

For example, in the United States, the number of claims for unemployment benefits, which is published weekly, is the primary indicator of the labor market, and its change has a serious impact on the price movements of the dollar.

Debt

Unlike the factors described above, the indicator of the external debt of the state has a long-term nature. In other words, this parameter should be considered when it comes to strategic investment for a period of a year or more.

The indicator we are talking about is the amount of public debt, or rather its ratio to the country’s GDP. If this parameter exceeds 100%, it is believed that the risk of higher inflation increases significantly and the central bank may decide to raise the interest rate. For example, the US national debt now stands at just over 30 trillion dollars and, in relation to GDP, the burden is more than 150%. This is a signal for rising inflation, which is observed in the US at the moment.

Political stability

The political situation is also a serious factor in currency fluctuations. When the political situation inside the country is unstable, retail investors have no desire to invest in its economy, therefore, few people will buy the national currency, which will lead to its depreciation.

Trading currency pairs

Despite the fact that the modern exchange provides an extensive set of trading financial instruments, Forex trading is still the most popular one.

What is currency pair?

Oddly enough, the phrase “currency pair trading and trading Forex” does not quite accurately reflect the process of exchange trading. On the currency exchange, participants trade in Forex pairs. They were formed because it became necessary to pay for a currency with another currency or with a commodity upon purchase. Let’s see the Forex trading example, we can buy the EUR USD pair (Euro – base currency, US dollar – counter currency), or buy the dollars for the yen (US dollar – base currency, Japanese yen – counter currency).

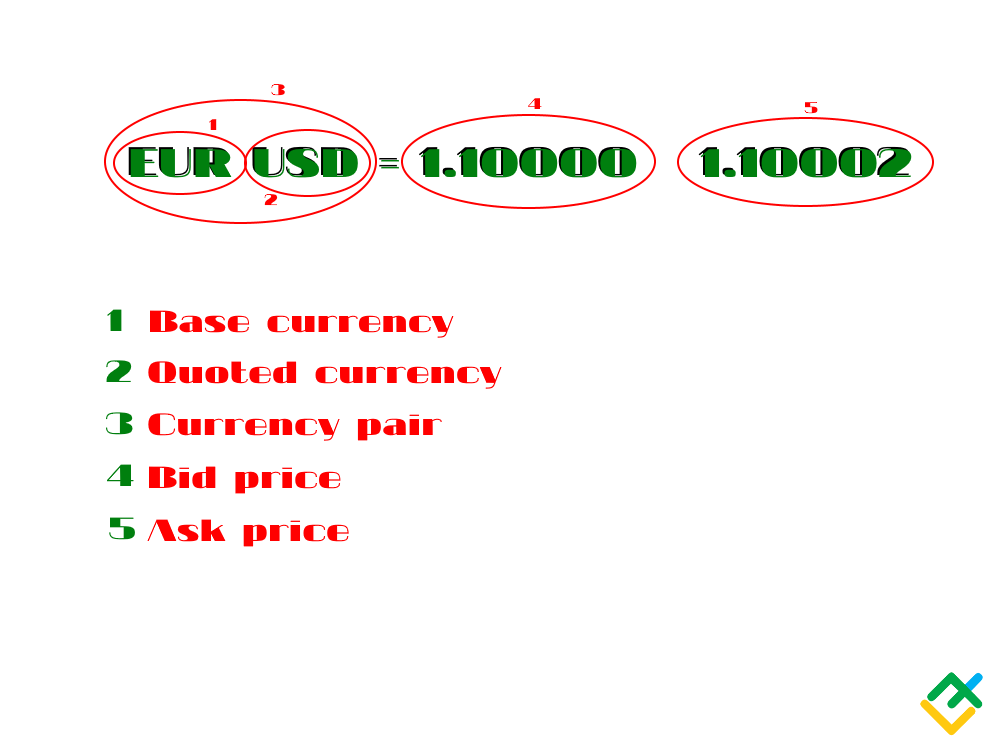

The figure above shows what Forex pairs look like. As an example, let’s look at the most popular pair — the EURUSD. This particular currency pair shows that a transaction is being made with EUR, which will be bought or sold for USD.

A currency pair always consists of two currencies. The currency with which you’re making the trade is called the base currency – it is always first in the pair. The currency for which you are trading is called the quote currency and it is second in the pair. In simple terms, the base currency can be described as the “commodity”, and the quote currency stands for the “money”.

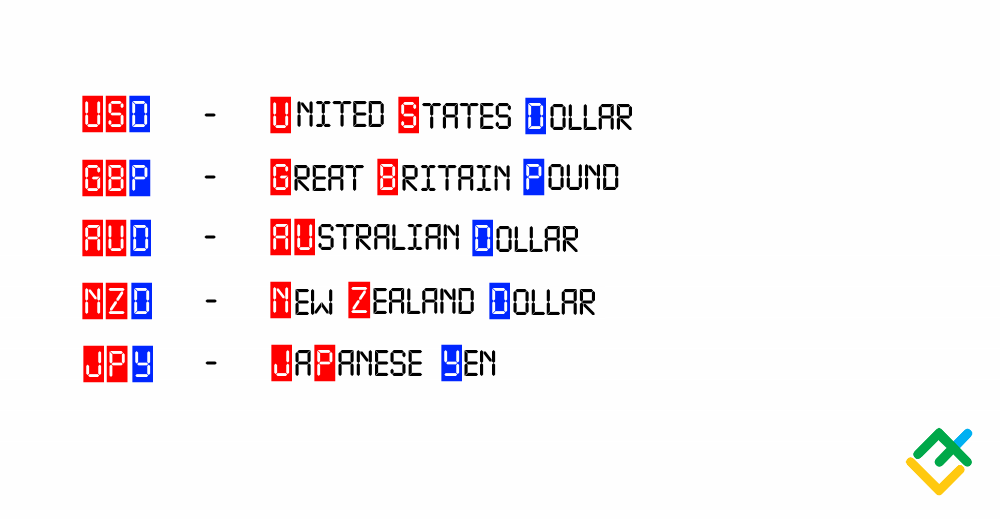

A currency pair, like any other exchange instrument, is presented in the form of a special code called a ticker. This is a short designation reflecting the names of the currencies and their countries.

The figure above shows the tickers of popular currencies. Usually it consists of 2 parts, where the first two letters are the name of the country issuing the currency, and the third is the first letter of the name of the Forex pairs.

Currency pairs on the exchange are divided into three broad categories:

1. Major pairs

Major currency pairs are the most popular currency pairs in which the US dollar is always one of the currencies. These pairs are the EURUSD, GBPUSD, USDJPY, USDCHF, and USDCAD.

2. Cross rates or minor pairs

We can safely say that minor pairs are also popular, but they are noticeably inferior to major currency pairs in terms of the traded volume. So-called cross-rates are also common in this category. They exclude the dollar from the calculations and represent a direct ratio of currencies’ exchange rates, such as the EURGBP or AUDCAD.

3. Exotic couples

Exotic currency pairs include all the remaining pair usually with low trading activity. They also include pairs with the currencies of exotic countries. This category includes the NZDSGD exchange rate, EURMXN, and USDTRY (USD — base currency, TRY — quote currency).

How to trade currency pairs?

Despite the apparent complexity of exchange trading, trading currency pairs on the modern Forex market (foreign exchange) is quite simple. The very process of opening and closing a position comes down to a few clicks. Most effort goes into determining the moment when you need to buy or sell a currency pair.

On the currency exchange, a trader can profit from trading in two ways. The first and most popular option is to buy a Forex pair while it is cheap, and close the position when it rises in market price, getting the difference between the opening price and closing price. The second option is to sell the pair when it is expensive, close the position trading when it gets cheaper, and get the difference.

The biggest challenge is to determine when the currency is cheap or expensive. To be able to find this moment, you need to take a course in trading and develop your own trading strategy. When you have the necessary knowledge, you will have no problems with this.

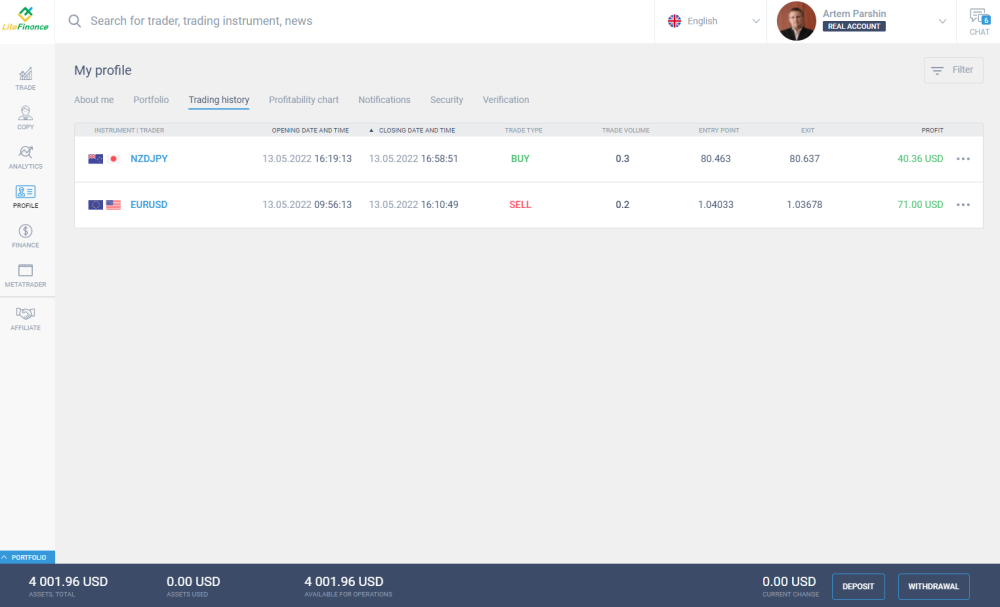

Below you can see two trades I made based on my own principles of technical analysis. The first trade was to sell, and the second one was to buy.

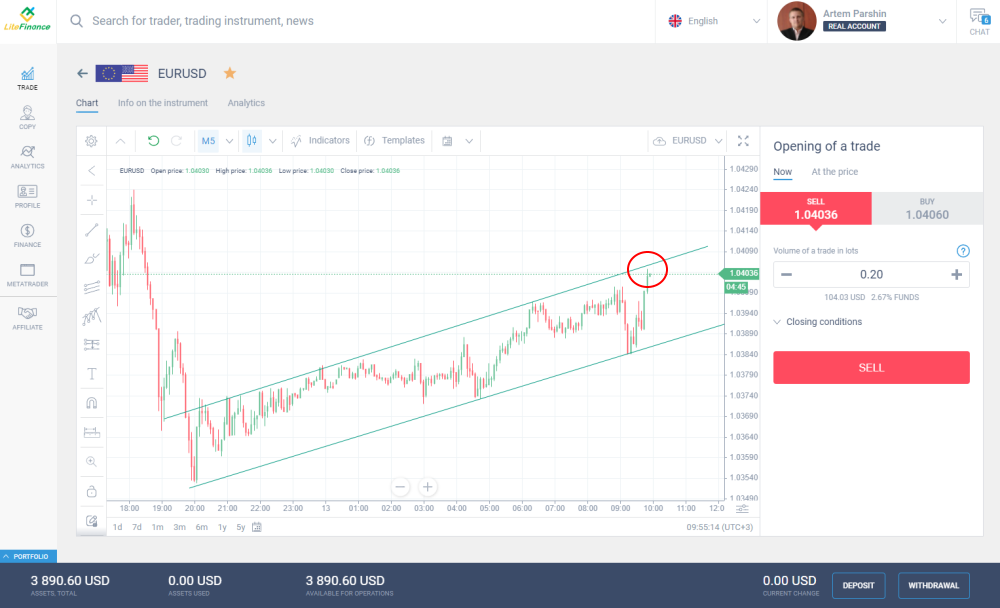

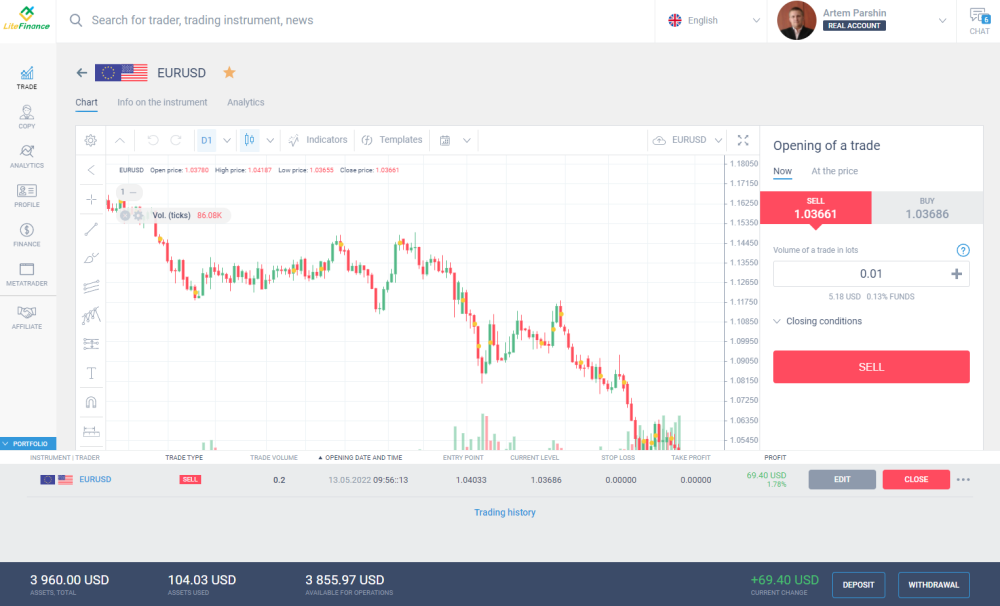

Sell:

Since my strategy is based on technical analysis, I am only interested in the currency price chart. Here I needed to determine the point at which, in my opinion, a trend change would occur. For this, I chose the EURUSD exchange rate.

We will need to determine the point of a possible trend change in the market price chart. I did this with the Flag pattern. According to the theory of this pattern, when the currency pair’s price reaches its upper limit, a reversal occurs. We can see this situation in the chart. If we believe that there will be a reversal, in order to earn, we need to sell, as the currency price will decrease.

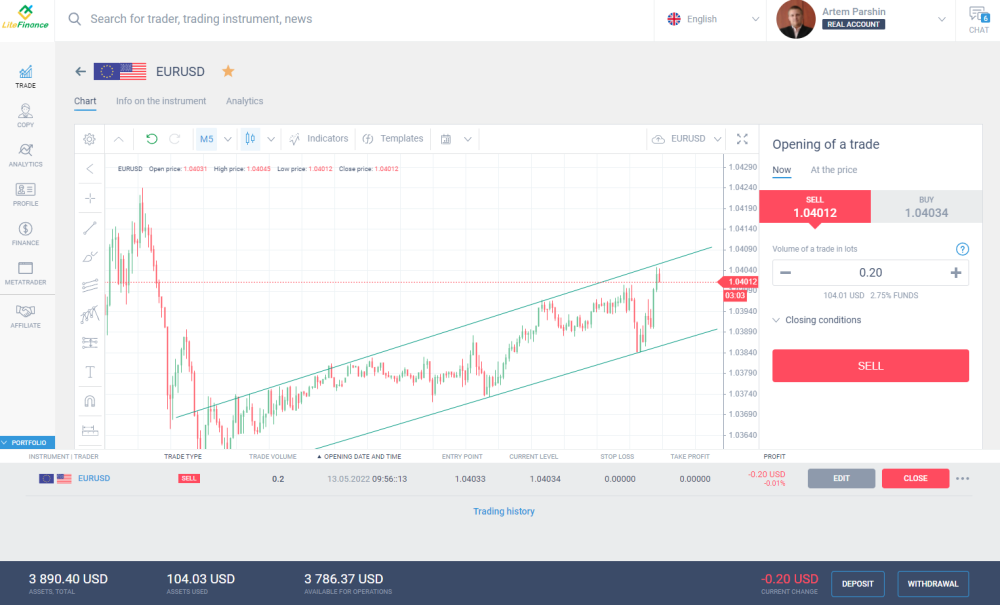

We select the required volume, which should not go beyond reasonable money management, and click the “Sell” button. After you have made a trade, it will be displayed at the bottom of the screen when you click on the line with the balance.

After some time, we can see that our trade was successful and the price really started to decline. The balance has become positive and you can take profit. To do this, you must click the “Close” button in the trade information field.

Buy:

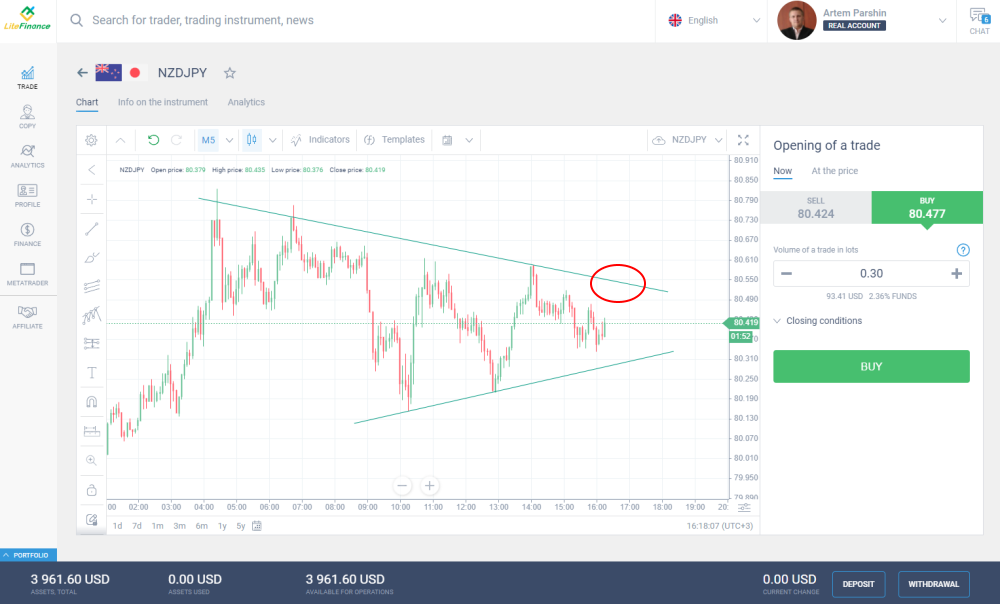

Now consider a buy trade. Here we need the price to rise after opening a trade. As with selling currencies, I’m interested in the point at which the trend will change. Let’s use technical analysis and price pattern theory. In this case, I decided to trade not a popular pair, but an exotic one — the NZDJPY.

We will determine the point of a possible trend change based on the Triangle pattern that is currently being formed. According to this pattern, the price will go in the direction of the border that will be broken. I decide that the upper limit will be broken and I am going to buy this currency pair.

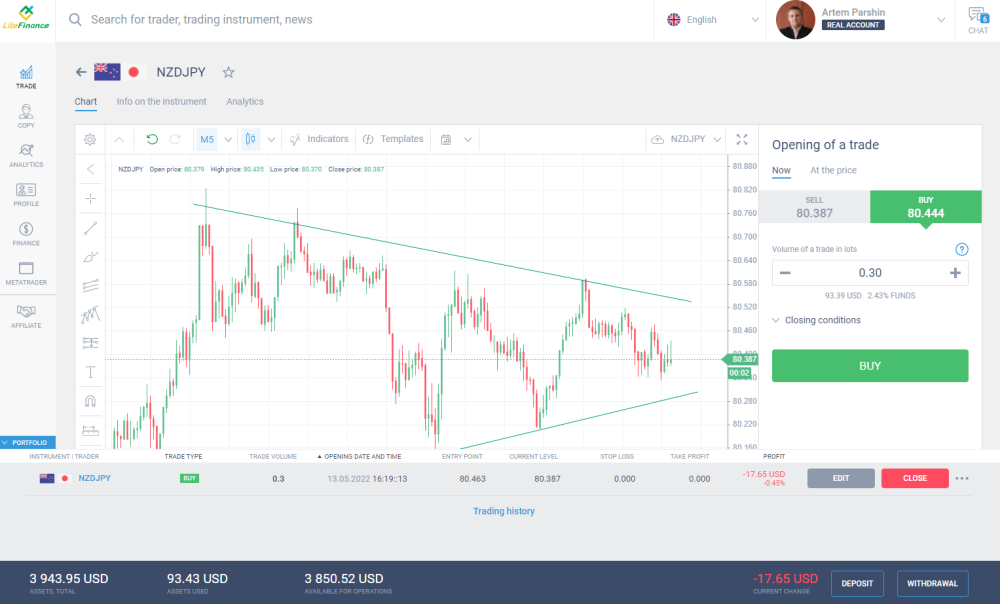

Set the volume, then click “Buy”. Like last time, the trade will open in the portfolio window.

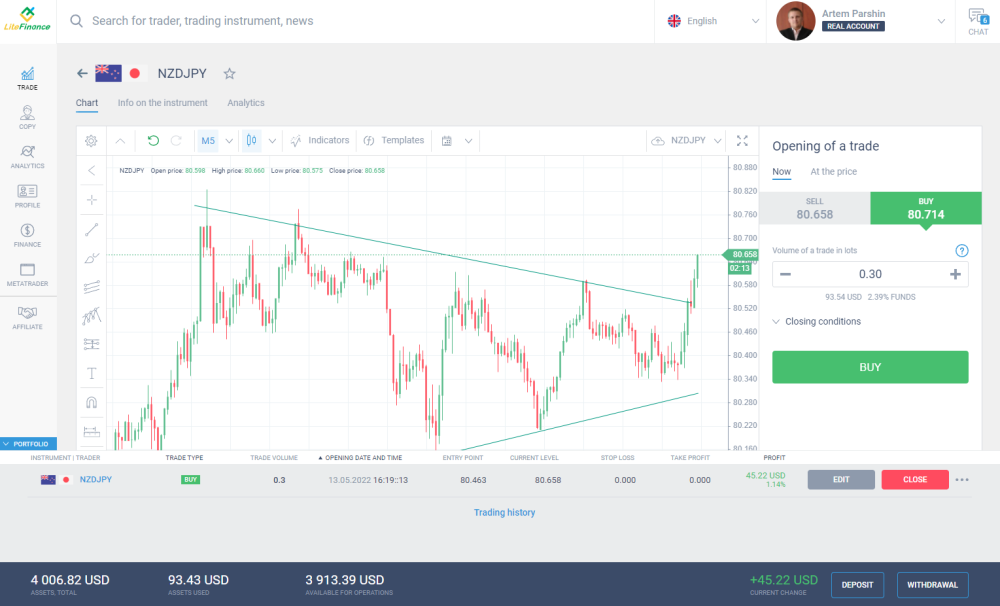

After some time, we see that the trade was successful and brought us profit. It’s time to take this profit. To do this, click the “Close” button.

If you click again on the trade information field, the trade history window will open. Here you can see our result.

Best currency pairs to trade

If you look at the history window again, you will notice that the profit in the buy trade is slightly less than the profit in the other trade, despite the fact that the volume was higher. This happened because the NZDJPY foreign exchange pair is not the best choice for trading and the income ratio for it is much lower than for the EURUSD. This is another reason to choose major currency pairs.

Here are some tips for choosing the best currency pairs to trade:

- High volatility;

- High income ratio close to 1.0;

- World currencies present in the pair;

- Low spread.

Currency trading software

When your trading skills reach a higher level, you may need special trading software. This includes both dedicated PC Forex trading platforms and mobile apps to keep you up to date with what’s happening on the market.

Currency trading platforms

The use of a Forex trading platform in trading is very important, because trading without a terminal is almost impossible. Fortunately, there is a wide range of different Forex trading platforms on the Forex market — some Forex brokers even develop their own. As for me, when trading on Forex, I use two main options.

PC platform MetaTrader 4 or 5

MetaTrader is the most popular Forex trading platform and, in my subjective opinion, nothing better has been invented. It is very easy to use, it has a user friendly and memorable interface, it includes many different functions. From my teaching experience, I can say that people learn to trade on MetaTrader much faster than on any other PC trading platforms.

Online trader’s cabinet from LiteFinance

I have been working with this broker for a long time and tested all its tools up and down, including the online cabinet, which has been edited and changed several times in my memory. Now I can confidently say that its latest version has inherited all the best features. I did like the dark theme in the first version better. However, the new cabinet is full of useful functions and features, from the built-in trading terminal, which you could see above in the screenshots, to the option of taking training courses and getting various achievements and merchandise.

Currency trading apps

As for apps, LiteFinance also has a very cool mobile trading app developed not so long ago, which is essentially a mobile version of the trader’s cabinet.

The need for such apps is quite obvious. WIth an app, you can stay updated of what is happening on the market. You can always open and close a trade, as well as monitor price movement, even if you are not at home and you can’t check your computer.

Currency trading robots

Speaking of trading apps, we should also mention automated trading systems, which are often called trading robots. A robot is an automatic implementation of a certain strategy. All the parameters of this strategy are recorded in the algorithm, such as the time of opening and closing a trade, stop order levels, and much more. Robots were created primarily to make the trader’s job easier, as they are able to make a huge number of trades in a short period of time and, most importantly, eliminate the emotional component.

Both the online cabinet and the MT4 platform have built-in trading robots. There is also a set of custom robots that you can download and integrate into the Forex trading platforms. MT4 even has a built-in automated strategy tester with which you can create your own robot.

If you want to dive deeper into this topic, I recommend that you read my colleague’s article “The 10 Best Forex Trading Robots for Automated Trading”.

Currency trading strategies

When speaking about trading currencies, one of the most important aspects is how these currencies should actually be traded. More precisely, let’s talk trading strategies.

Day trading currency

This is the most common Forex trading strategy. Its point is to make trades within the trading day to avoid swap, i.e. the overnight fee. You can make anywhere from 1 to 10 trades per day.

Its advantages include:

- No swap;

- Convenient timeframes from H1 to H4;

- Instant results;

- Low emotional pressure.

The disadvantages of intraday trading include:

- High spread and commission costs;

- High potential risks;

- The need for constant monitoring.

If you are interested in this strategy, my colleague described it in great detail in the article “Day Trading for Beginners” — feel free to read it.

Currency exchange investment

This strategy is more suitable for retail Forex traders with a large deposit – it is not recommended to use it if you have less than 10 thousand dollars in your trading account. However, it reveals the potential of Forex trading like no other. You buy the currency pair you are interested in for the long term, sometimes up to a year or more. Primary analysis, most often fundamental analysis, is very important here. After identifying the main trend, you make a trade with a large leverage and an equally large amount of margin in order to avoid falling victim to market noise.

I can give an example of such trading from my own experience. At the end of February, I had a consultation with one of my students on the prospects for the movement of the EURUSD pair. Considering the huge problems in the EU economy, as well as the reverse effect of economic sanctions against the Russian Federation, we came to the conclusion that by mid-summer 2022, this currency pair will cost approximately 1 to 1 to the dollar, i.e. 1.0000. Based on this decision, he sold the pair for about 1.1100 (I don’t remember exactly). He had a good margin on his account, more than 10,000 USD, so he comfortably opened a trade for 2 lots with a leverage of 1 to 500. If we calculate the current value of this trade, with the current quote of 1.0430, his profit is already at 13,300 dollars . And this is despite the fact that the price has not yet reached the target level.

Short selling currency market trading

As you have already noticed, you can not only buy, but also sell currency pairs. This also applies to all other Forex market financial instruments, be it stocks, metals, oil, or other financial markets. This is possible because you are not buying the asset itself, but rather a contract for difference (CFD), currency futures, and other complex instruments. With Forex CFDs you simply buy or sell the difference between the opening and closing currency values. At the end of the Forex CFDs trade, it can be either positive or negative for you. Always keep in mind that trading CFDs is risky and requires much knowledge and trading experience.

Trend trading

Trend trading is the safest option. All modern retail Forex traders know the expression formulated at the beginning of the 20th century by the father of technical analysis Charles Dow: “Trend is your friend”. This means that when trading in the direction of the current trend, the risks of loss are much lower.

Today there are many types of trending strategies, but if we consider its classic version developed by the same Dow, the essence is to trade while the trend is in effect, and do nothing when the trend changes. Identifying a trend is very simple. An uptrend is active when each subsequent price high is higher than the previous one. You’re seeing a downward trend when each subsequent low is lower than the previous one. If this rule is violated, you should exit the trades.

Support and resistance trading & Breakout trading

The concept of levels or lines of support and resistance follows from the very concept of trends. A support line is one that you can draw through all the major lows of a directional trend. Resistance line is the one which can be drawn through the highs.

Based on the interaction of price with support and resistance lines, one of the most popular trading strategies was developed – the breakout trading strategy.

The principle of this strategy is entering a trade at the moment when the price breaks through one of the lines. Sell trades should be opened when the price breaks the support line, and buy trades should be opened when the price breaks the resistance line.

Tax on currency trading

Taxation always raises many questions, especially from beginners. We know that in every country in the world there is an income tax that everyone who earns must pay. Exchange activity, like any other, is also taxed.

However, while stock trading on the stock exchange is absolutely always subject to income tax, with trading Forex it’s not so simple. When calculating your income tax, you need to look at who the tax agent is according to the laws of each country. If it is a broker, they must pay tax for each of their clients. If the client is a tax agent, it is their responsibility.

You should also pay attention to the jurisdiction in which the broker is registered. If this is an offshore zone, then the client is the agent, but since this is a tax-free zone, the client does not have to pay any taxes. However, if you get large amounts credited to your bank account, your country’s authorities may have some questions.

The history of Forex trading with a broker registered offshore doesn’t know situations when a trader was accused of tax evasion. As for me, I paid the tax once – the broker deducted it from my account when withdrawing profits. After that, I switched Forex brokers and never had this issue again.

Currency market trading tips

It’s time for a list of tips from a professional. I have compiled a list of rules for you. If you follow them you will earn money on Forex trading.

- Choose your broker carefully! You need to be able to focus on the trading process rather than constantly calling the support service.

- Explore the Forex trading platform. The trading process should be reduced to a few simple steps, without wasting time looking for buy or sell buttons.

- When you’ve made a decision — go for it! If the decision to sell or buy has been made, lose all doubts and make a trade. As a rule, the first decision is the best one. Ruminating only gets in the way.

- If you want to make a long-term trade, pay attention to the swap. I know many stories when people calculated the direction of the price movement correctly, but lost all profits due to the high overnight commission.

- Use restrictive orders. Even if you are 100% sure that your decision on the Forex market is correct, always set Stop Loss and Take Profit. Perfect analysis is powerless against price shocks.

- Ask for advice only when all Forex trades are closed. Never ask for opinions on open trades. When you opened them, you were confident, so drop your doubts and do what you know and can do.

- Always follow the rules. This is a key element of my Forex trading strategy. If you break even one rule of the Forex market, you can forget about the profit.

- “Don’t put all your eggs in one basket”. This is a quote from the author of one of my favorite trading books Benjamin Graham. The bottom line is that if you can trade yourself and invest at the same time, choose both options. If you can invest in several individual traders or trading systems at once, do so.

I can recommend a system that will allow you to invest in professional traders and learn from them at the same time. The era of trust management and PAMM services is long gone – the trading world today is investing in the Social Trading copy trading system. Choose a trader according to your parameters and duplicate their strategy. As I said above, if you match several traders, they will hedge each other, which will reduce the risk and let you protect your account from losing money rapidly due to high volatility.

Risks Associated With Currency Market Trading

The risk in Forex trading is no different from the risk in trading other complex instruments. If you buy or sell a currency, you are always at high risk because your analysis may not be correct. Instead of growing, the chosen instrument may decline and make your retail investor account lose money. No one is immune from this, and you must be able to take proper measures.

Speaking about the high risk of losing money rapidly, one should understand one thing – there is only a seller and a buyer on the exchange. When you buy, someone else sells. Therefore, if you make a profit, then the other side of the transaction suffers losses. Most importantly, follow the rules, use restrictive orders, and don’t do anything rash. Then the probability of you profiting will be higher than the risk of losing money rapidly.

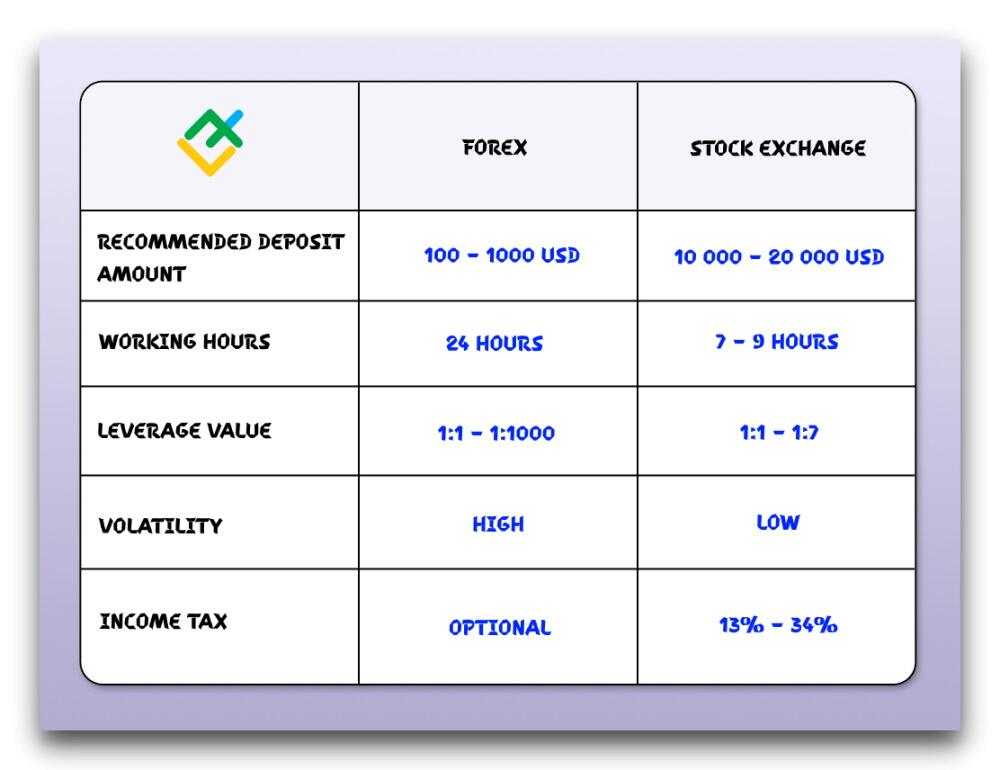

Pros and cons of trading currency

There are a lot of differences in trading Forex and stocks on the stock exchange. I have gathered the most important ones for you in this table.

It’s entirely up to you what to choose, but it is obvious that Forex trading is much more suitable for a beginner due to the low threshold of funds required to start trading.

Currency Trading vs Stock Trading

It’s time to sum up and highlight the positive and negative aspects of Forex trading.

Pros:

1. A lot of different currencies

The Forex market provides the opportunity to trade almost all major currency pairs, from the US dollar to the Mexican peso. So everyone can find a currency pair that suits them.

2. High volatility of intraday fluctuations

The Forex market is the most volatile and liquid financial market in the world, which means that you can trade both within the trading day and on any longer period. It also means that you can get the result of the trade within a few seconds from the moment it was opened.

3. Available high leverage

The currency exchange allows you to increase the size of the trade by tens or even hundreds of times, which means you can earn more. Despite the fact that high leverage entails an increased risk of losing money, it should be considered an ally, since there is no other way you can earn 1,000 USD with as much as 100 USD on your account.

4. You can open locking and same-direction positions

Not a single exchange in the world provides individual traders with the opportunity to open several trades independent of each other in one currency pair in the same direction. When trading on the stock market, your Forex trades are simply summed up. However, while trading Forex, you can use this option as an independent risk management strategy. Moreover, when opening multidirectional trades in one instrument, your trade on the stock market will simply close. On the Forex market, both of these positions will exist independently of each other.

5. Small initial deposit

The ideal option for any beginner would be to open an account for up to 1,000 USD and practice. Trading Forex provides such an opportunity, because you can start trading even with 50 USD.

Cons:

1. High risk of losing money

As I said before, high leverage also increases risk. It can make your retail investor accounts lose the entire deposit to insufficient knowledge or emotional impulses.

2. Need for constant monitoring

This is typical for intraday trading. You have to constantly monitor the trading process and carefully evaluate all price fluctuations.

3. High probability of broker fraud

Despite the fact that Forex trading has become safer, cases of outright fraud still occur. To avoid these problems, you should carefully select online brokers.

4. High costs in long-term trading

A trader may simply forget to pay attention to swap. If the swap is negative and the currency pair is exotic, the trader may well lose profit on the trade. You should carefully review all the parameters of your trades.

5. Slippage and requotes

When trading intraday and placing limit orders, you can often encounter price slippage. In this case, your orders will either be shifted or cancelled altogether. This situation is a natural consequence of increased volatility, especially during the publication of important macroeconomic news.

Conclusion — can you make a living trading currency online?

Yes, you can! This is a pretty straightforward answer, but it’s true. The problem is that only a few succeed. And it’s not about the market or Forex trading providers who only dream of scamming the poor trader, or even expensive commissions and spreads. The problem is within ourselves. A human is by nature a greedy and emotional being. When one makes a profit, they always want more, when they get a temporary loss, they turn off logic and turn on greed and fear.

Earnings on the exchange market can be compared with a victory in sports – it is not easy to achieve. To get ahead of your rivals, you must have skills and knowledge. If you have all this, you will earn. I succeeded, why can’t you? To achieve something, you need a Forex trading plan. In trading, if you have a clear trading plan, you will make a profit, if there is no Forex trading plan or you violate it, you will lose. And earning 20% to 30% of your deposit per month by trading Forex is quite realistic.

To create a real forex account for free, click here